The six years leading into 2022 have painted a picture of a continuous bull market in the IPv4 industry.

Prices for IPv4 address blocks had an average increase of around 25% every year due to limited availability and increased demand. However, this year has proven that even the IPv4 market can’t always be resilient to economic conditions.

The current stock market correction, the war between Russia and Ukraine, and rising interest rates have impacted many organizations’ budgeting and cash allocation strategies. So, how has this impacted global IPv4 prices and the overall appetite for acquiring more IP addresses this year?

As we have discussed in previous articles, 2021 was the biggest bull market we have ever seen. Prices increased by 100% in less than one year, and many companies decided to sell IP addresses to take advantage of the increase in value. Following the bull market, demand steadily decreased, which has yet to correct or sustain at the same levels they were in previous years.

Promising Data

The previous 2 months of IPv4 transfer request data seemed to be promising, helping bring the yearly average to 152. This would have led us to believe that we were starting to see the resurgence of a healthy market. In October however, transfer requests fell again to only 119, which is down -21% as compared to this year’s average.

The inconsistency of IPv4 demand and oversaturation of the market has been driving IPv4 prices down. Our latest data analysis found that not all IPv4 block sizes were affected equally. Here are the prices you can expect to see on any given week in the global internet registries including ARIN, RIPE and APNIC, subject to availability and demand.

IPv4 Address Block Price Ranges

/24’s – /22’s = $40 – $50 per IP

/21’s – /19’s = $45 – $50 per IP

/18’s – /17’s = $48 – $51 per IP

/16’s – /12’s = $50 – $56 per IP

As the IPv4 industry has matured over the past 7 years, /16s and larger IPv4 blocks have consistently demanded higher prices than the smaller subnets. They are scarce and much more desired for use by the largest global cloud companies, Internet Service providers and hosting companies.

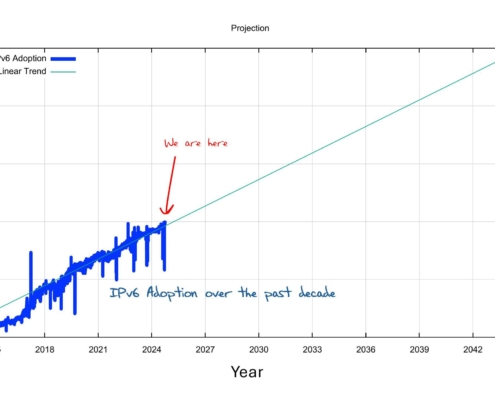

While the pool of buyers for large IPv4 subnets is quite limited, they continue to purchase hundreds of millions of IPv4 addresses on a yearly basis. Their purchase cycles and continued demand lead us to believe that IPv4 will continue to play a significant role in global internet connectivity for years to come.