The Impact Market Cycles on IPv4 Pricing & Demand

The IPv4 market has seen significant stabilization in 2024, driven by a confluence of factors including surging demand, increased transaction volumes, and ongoing supply shortages. With IPv4 addresses remaining a finite resource, their value has solidified as small and mid-sized ISPs, hosting providers, and proxy companies and data scrapers powering AI initiatives continue to dominate purchases. These organizations are particularly focused on acquiring /24 up to /19 IPv4 subnets to scale their operations, meet customer needs, and maintain competitive advantages in their industries.

The small to mid-sized IPv4 market saw prices begin to climb slightly in Q4 of 2024. Driven by consistent demand, prices for /24 to /19 subnets finally reflected the scarcity of available resources. This modest price increase signals a broader stabilization in the market, as smaller players compete to secure essential IPs amid tightening supply.

Conversely this year, hyperscalers’ significantly reduced their purchasing activity for IPv4 addresses, causing a ripple effect in the market for larger subnets like /18s to /16s. With reduced demand from these major players and an influx of supply from their offloading efforts, prices in this segment dropped around -33%, stabilizing at approximately $30 per IP. This shift created a backlog of large subnet supply and a very competitive buyers market.

In any case. the growing reliance on IPv4 addresses has intensified due to limitations IPv6 adoption and CG-NAT making IPv4 increasingly critical for businesses requiring immediate deployment. The limited supply of IPv4 subnets has pushed market participants to act decisively, ensuring consistent trade activity and stable pricing trends last year. This stabilization reflects a matured market dynamic where buyer demand has started to rise once again after a couple of less active years. Let’s take a look at some of the data as compared to previous years.

| Year | Average Demand | Demand Change (Y/Y) | Average Price Per IP | Price Changes (Y/Y) |

| 2019 | 166 | 0% | $20 | 18% |

| 2020 | 167 | 0% | $24 | 20% |

| 2021 | 156 | -7% | $38 | 58% |

| 2022 | 134 | -17% | $48 | 26% |

| 2023 | 141 | 5% | $41 | -14% |

| 2024 | 145 | 3% | $34 | -17% |

Based on the data provided, the IPv4 market in 2024 reflects a continuation of normal market cycles characterized by shifts in demand and pricing trends. After the significant price corrections in 2023 (-14% year-over-year) and 2024 (-17%), the current pricing environment indicates stabilization, particularly as demand has increased modestly by 3% in 2024 compared to a 5% rise in 2023. These shifts demonstrate a rebalancing phase after a period of heightened volatility in 2021 and 2022, where prices surged by 58% and 26%, respectively, due to constrained supply and rising demand.

This cycle of price corrections and modest demand growth suggests that the market is preparing for another potential upward swing as supply tightens. Historical trends show that demand rebounds after periods of stabilization, and the small increases in demand seen in 2023 and 2024 could be early indicators of renewed competition for IPv4 resources. As businesses continue to expand their networks and IPv6 adoption remains slow, the market is likely to see growing pressure on prices in the coming years.

Brander Group’s Impact on the Global IPv4 Market

In 2024, Brander Group successfully assist with 724 IPv4 Transfers globally, consisting of 3,426,304 IP Addresses, with total sales revenue of $154 Million (USD).

Our total number of transfers increased by +39% over last year as we contributed to around 35% of total IPv4 transfers every month globally. We experienced a slight -10% decrease in the total number of IPs transferred compared to 2023. Our overall sales revenue was also down -19% over 2023.

2024 was pivotal with a strong push in demand in small to mid-sized subnets. This has been consistent with the data we published in most market trend reports over the year. This is backed up by our transfer data and sales revenue.

2025 has already began with an increased demand for /18s and larger. Our team has also noticed a massive decrease in available inventory of /24’s through /19’s. We anticipate the same trend to continue throughout the year, which should cause prices to increase for larger subnets later in the year.

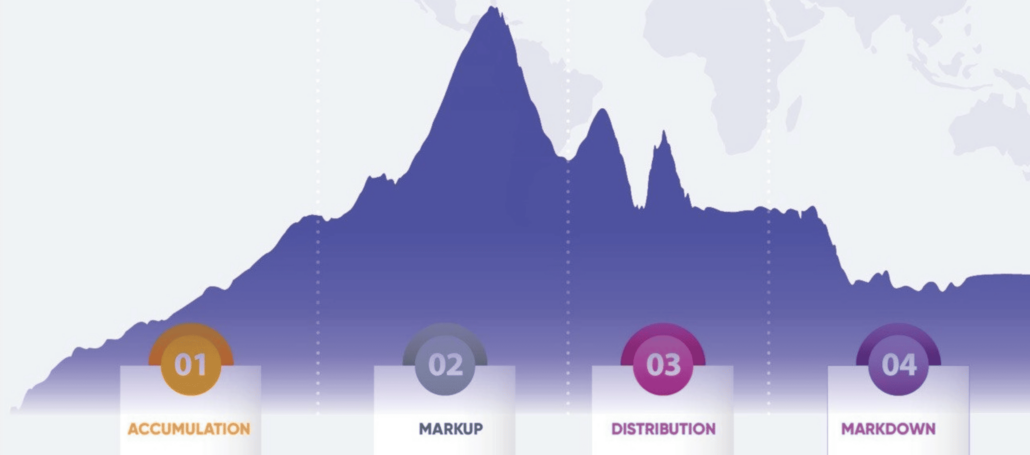

4 Stages of a Market Cycle

Prices peaked in 2020 during the Markup phase, followed by Distribution from 2021 to mid-2023, as high prices slowed activity. Late 2023 to mid-2024 demonstrated the Markdown phase, with prices falling sharply as hyperscalers reduced purchases of larger subnets like /18s to /16s.

As 2025 approaches, the market appears to be entering a new Accumulation phase. Demand is rising while available inventory tightens, creating opportunities for strategic buyers to secure IPs before the Markup phase returns. With IPv4 addresses remaining critical and scarce, this cyclical pattern suggests another period of price growth may be on the horizon.