2025 IPv4 Pricing Review: Prepare For the 2026 Market

The 2025 IPv4 market reached a state of “stabilized correction,” marked by a decoupling of total transfer volume from price levels. While the rapid price drops of previous years began to level off, the market adapted to a new baseline defined by consistent mid-market activity and a record-breaking surge in total address liquidity.

The defining characteristic of 2025 was a significant surge in the sheer volume of addresses changing hands. Despite a more cautious purchasing strategy from major tech giants, total IPv4 transfers saw a massive spike. After a period of relative consistency—moving 43 million IPs in 2023 and 45 million in 2024—the market reached a new peak of 58 million IPs transferred in 2025.

This 28% year-over-year increase in volume, paired with a 33% decrease in price, highlights an inverse correlation between demand and pricing. This trend demonstrates the outsized impact of hyperscalers; as these large players reduced their aggressive bidding, the market opened up for a wider variety of participants to acquire resources at a lower cost, resulting in higher transaction volumes at lower price points.

| Year | Avg. Demand | Demand (Y/Y) | Avg. $ Per IP | Price (Y/Y) | IPs Transferred | Transferred (Y/Y) |

| 2015 | 30 | NA | $9 | NA | 55M | NA |

| 2016 | 136 | 353% | $11 | 22% | 33M | -40% |

| 2017 | 170 | 25% | $14 | 27% | 65M | 96% |

| 2018 | 158 | -11% | $18 | 28% | 60M | -7% |

| 2019 | 166 | 5% | $23 | 27% | 41M | -31% |

| 2020 | 167 | 0% | $29 | 26% | 44M | 7% |

| 2021 | 156 | -7% | $38 | 58% | 36M | -18% |

| 2022 | 134 | -17% | $48 | 26% | 50M | 38% |

| 2023 | 141 | 5% | $41 | -14% | 43M | -14% |

| 2024 | 145 | 3% | $34 | -17% | 45M | 4% |

| 2025 | 150 | 3% | $25 | -25% | 58M | 28% |

The Hyperscaler Shift and Price Correction

According to ARIN data and broader registry trends, monthly demand remained remarkably steady, averaging roughly 150 transfer requests per month with less than 10% volatility month-over-month. This predictability provided a much-needed foundation for market participants.

Hyperscaler Influence: Major cloud providers and hyperscalers purchased less overall than in previous years. However, their footprint remained massive, as they still dominated the landscape by acquiring tens of millions of IPs combined to maintain their global infrastructure.

Pricing Thresholds: The reduction in aggressive bidding from these major players led to a market-wide price correction. Average prices for /24s to /19s dropped from $34 per IP to approximately $25 per IP, a decrease of roughly 25% over the year. While prices for /18s and larger decreased to an average of $19 per IP for the year

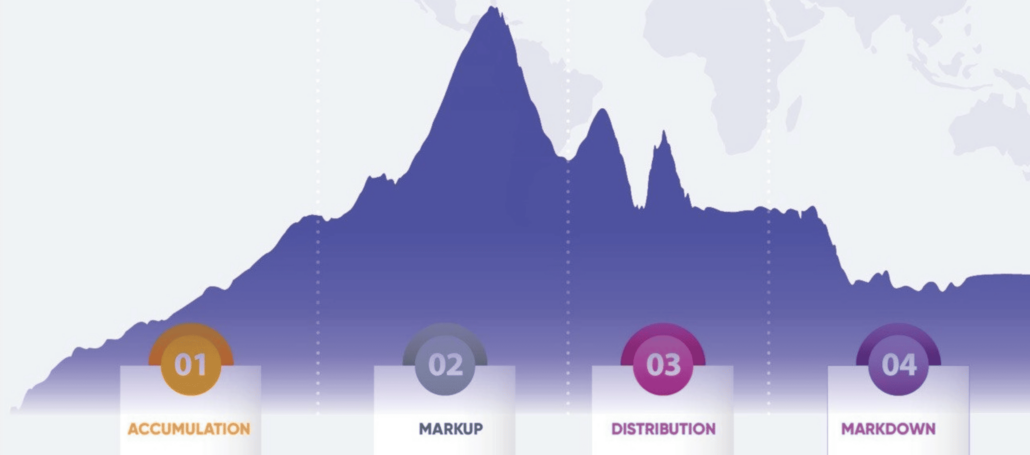

4 Stages of a Market Cycle

Markup (2020)

IPv4 prices reached their peak in 2020 as strong demand and limited supply pushed valuations sharply higher.

Distribution (2021–mid-2023)

From 2021 through mid-2023, elevated prices slowed transaction activity. Holders increasingly sold inventory while buyers became more selective, signaling a transition out of the peak.

Markdown (2023-2025)

2023 through 2025 marked a correction phase. Prices declined as hyperscalers reduced purchases of larger subnet blocks, particularly /18s and /16s, increasing downward pressure on the market.

Accumulation (2026 onward)

As 2026 begins, the market appears to be entering a new accumulation phase. Demand is rebuilding while available inventory tightens, creating opportunities for strategic buyers to acquire IPv4 assets ahead of the next markup cycle. With IPv4 remaining both scarce and operationally critical, historical patterns suggest renewed price growth may be approaching.