Posts

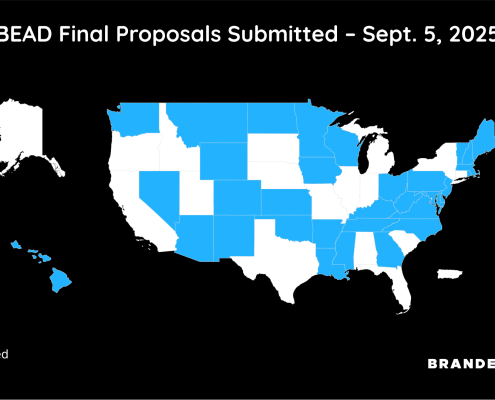

NTIA Approves 18 States to Receive $9 Billion in BEAD Funds

BEAD NewsNTIA has approved the first 18 BEAD Final Proposals, unlocking nearly $9B in funding and projecting $6B in savings. States can now begin real broadband buildouts, marking the program’s first major forward momentum.

Pew Study: BEAD Funding Opens Workforce Opportunities

BEAD News, IPv4 BlogPew Charitable Trusts reports that BEAD’s $42.5 billion broadband rollout will require tens of thousands of new fiber and telecom workers

BEAD Broadband Status: Awards by State, October 2025

BEAD NewsNearly all U.S. states have submitted final BEAD plans. October 2025 broadband awards, allocations and NTIA updates

Nebraska BEAD: A Case Study in Missed Opportunity

BEAD NewsNebraska’s BEAD plan leaves $350M unspent and prioritizes short-term wireless over fiber — a warning for how states manage federal funding

Alabama Finalizes $800 Million BEAD Broadband Plan

BEAD NewsAlabama’s broadband agency has officially submitted its BEAD plan — access for 101k locations, cutting $800 million in costs

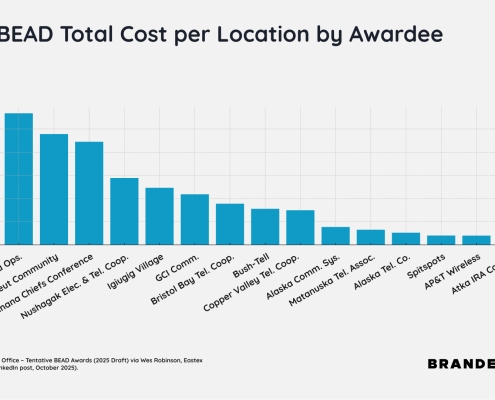

Alaska’s BEAD Plan – $113,000 Per Home Sparks Debate

BEAD NewsAlaska’s Broadband Equity, Access, and Deployment (BEAD) proposal has drawn national attention for its staggering per-location costs. With some projects topping $113,000 per home

Nevada’s Plans $327 Million In Broadband Expansions

BEAD NewsGovernor Joe Lombardo announced $327M for broadband projects across Nevada, aiming to connect 50,000 homes, businesses, and community sites

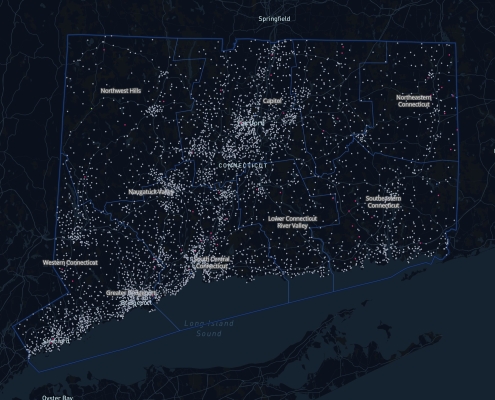

Connecticut’s $154M Fiber Push Reshapes Telecom Strategies

BEAD NewsConnecticut’s $154M fiber initiative shows how Comcast, Verizon, and Charter are shifting broadband strategies and setting the pace for the U.S. market.

BEAD “Benefit of the Bargain” Provisional Awards

BEAD NewsStates are currently in a synchronized phase of "Benefit of the Bargain". We have provided a comprehnsive list of each state's provisional awards, organizations names, and monetary amounts.

New York Governor Unveils $636 Million Broadband Expansion

BEAD NewsNew York advances $636M in broadband awards to 11 providers, targeting 54,000 homes with fiber, wireless, and satellite