Posts

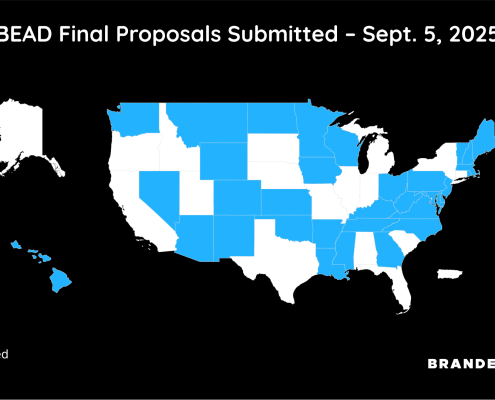

States Share BEAD Broadband Distributions Plans

BEAD NewsBEAD program advances as multiple states submit BEAD funding released and distributions between fiber, wireless and satelite

Montana Awards $145 Million to Starlink and Kuiper in BEAD Funds

BEAD NewsMontana’s BEAD program directs $119M to Starlink, serving 20,000 rural sites. Satellite awards dominate state broadband funds.

Minnesota’s BEAD Funding Trimmed from $652 Million to $392 Milllion

BEAD NewsMinnesota broadband projects, backed by BEAD and local providers, are connecting 75,000 locations and powering statewide economic growth

Ohio Received $793 Million in Federal Broadband Funds

BEAD NewsOhio awards Starlink $51.6M to connect 31,000 rural homes. Satellite wins 41% of BEAD sites, outpacing Spectrum and other ISPs

West Virginia $624.7 Million Rural Fiber Projects

BEAD NewsWest Virginia proposes $624.7M in BEAD funding for nine fiber providers, led by Frontier, Citynet, and a small Starlink award.

Nebraska Risks $350M Broadband Setback Without Fiber

BEAD NewsNebraska left $350M in BEAD funds unspent, backing satellite over fiber. Advocates warn rural communities risk slower, less reliable internet

Pennsylvania $793M Broadband Expansion in Provisional Grants

BEAD NewsPennsylvania provisionally approves $793M in BEAD funding to expand broadband statewide, with fiber, wireless, and satellite providers.

$826M Colorado BEAD Funding Underway

BEAD NewsAmazon Kuiper and Starlink secured a small percentage, around 8% of Colorado’s $826M BEAD broadband funding.

2025

2025Virginia Steers $613M Broadband Funds Mostly To Fiber

BEAD NewsVirginia's $613 million BEAD program allows SpaceX’s Starlink and Amazon’s Project Kuiper a share, however focuses mostly on Fiber projects

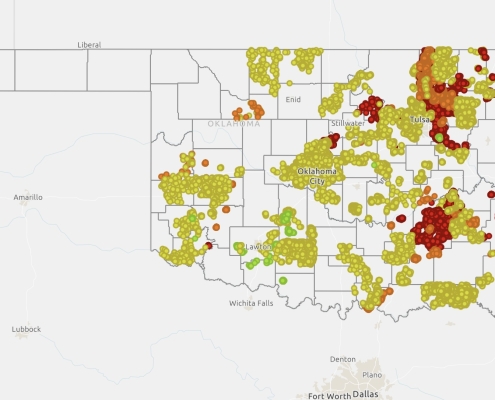

Oklahoma’s $797 Million Dollar Broadband Expansion

BEAD NewsOklahoma accelerates broadband rollout with BEAD and ARPA funds, despite changing federal rules. Fiber, wireless, and satellite all compete.