The IPv4 Market has continued to surprise us all this year, given the current global economy. Our team has continued to follow the transfer trends and use that data to inform our partners and clients on the ever-changing dynamics of the IP address marketplace. Whether you are getting ready to buy IP addresses or sell unused IPv4, reading this short post will help you get a confident stance on where we might be headed as we approach the 4th quarter of 2020.

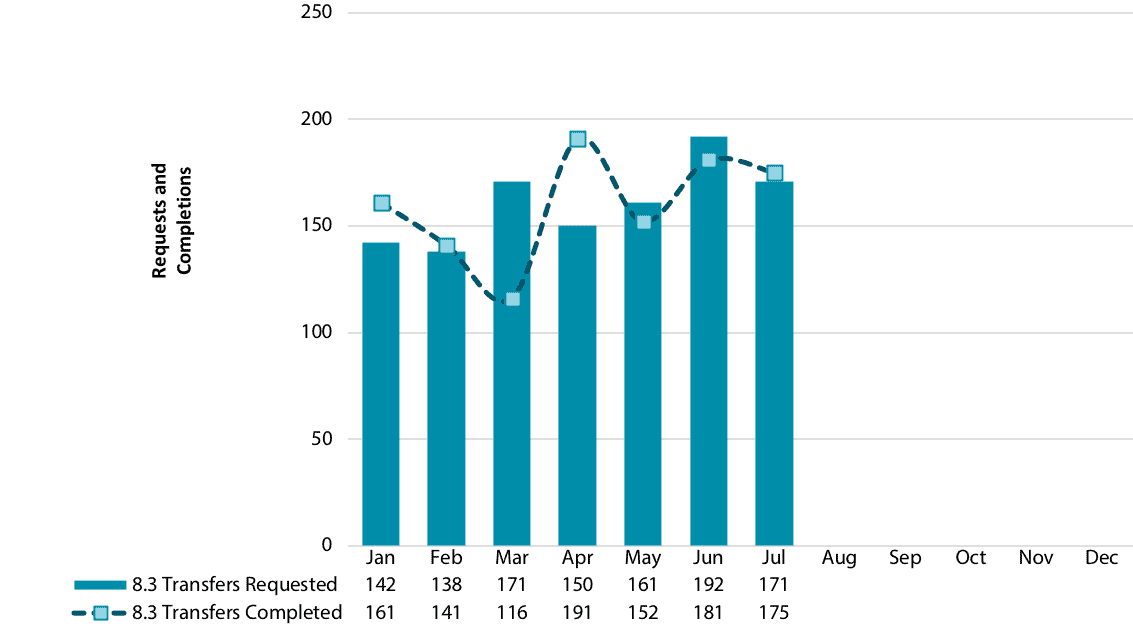

Though it would appear that Pv4 sales and transfers would struggle this year, there seems to be an upward trend in the ARIN IPv4 transfer market. While we saw -6% decrease in demand for IPv4 transfer in Q1 2020 over the previous quarter, Q2 has seen an increase of +12% over Q1. This could be due to more confidence among ISPs and hosting providers whose customers depend on providing them with reliable and secure internet connectivity during an epidemic that requires more of us to work from home.

However, it is important to note that If you look at IPv4 demand in Q2 2020 vs Q2 2019, we see a -9% decrease overall. This can obviously be attributed to a volatile market which leads to decreased budgets and spending across most industries and companies.

While the IPv4 transfer activity has decreased this year, companies continue to buy IP addresses as quickly as they hit the market. This has kept the inventory relatively low, while maintaining the integrity of IPv4 sales prices in ARIN, RIPE and APNIC.

ARIN-IPv4_transfers-August-2020

Other Popular Blog Posts

Discover more from Brander Group

Subscribe to get the latest posts sent to your email.

2020

2020