With the end of a roller coaster of a year, 2020 had some interesting movement in the IPv4 sector as well. Due to the increased demand for people to stat indoors, we saw a surge of requests to buy ip addresses shortly after the pandemic hit. Even more interesting, was the companies that were ready to sell IPv4 leading into the pandemic, were side tracked by Covid response efforts. This caused the IPv4 market to go into a frenzy as the supply wasn’t able to keep up with demand.

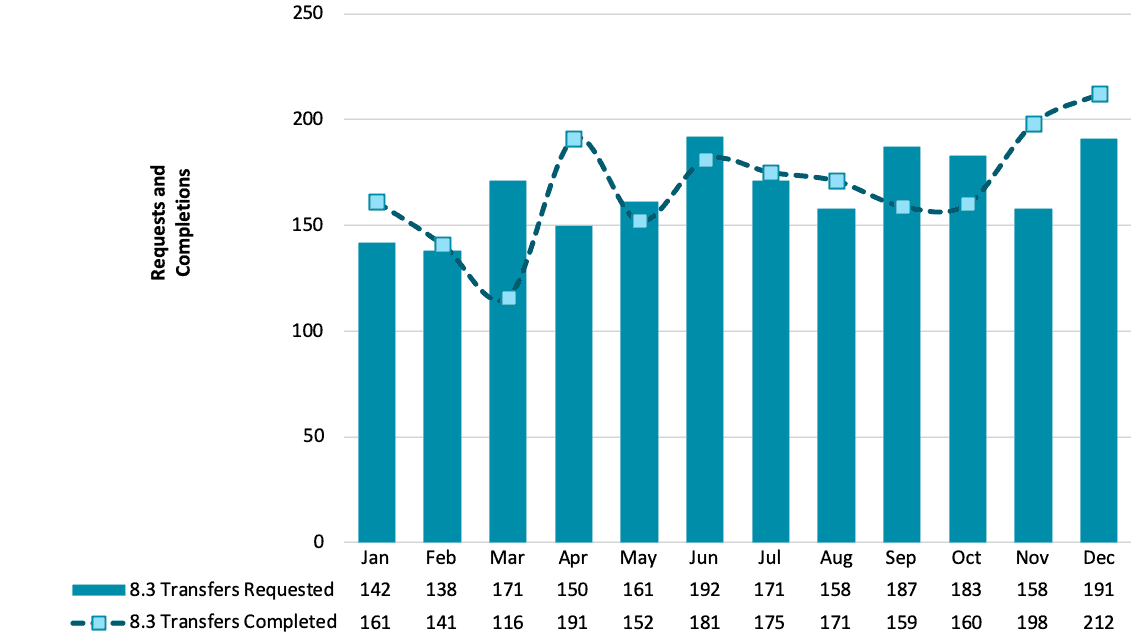

In Q4 2020 we saw only a +3% increase of the number of requests over Q3 of 2020. Even more interesting, is the transfer completion rate increase to 107%. It would seem that the suppliers who were delayed earlier in the year, were finally able to refocus back on IPv4 re-addressing and bring their IP addresses for sale into the market. Another interesting metric to point out is that we see a significant double digit increase of demand for IPs when you compare Q4 of 2020 to Q4 of 2019, with an overall +11% spike.

Overall 2020 represented a very strong and healthy IPv4 market, especially when you compare it to most industry sectors. The IPv4 transfer market demand stayed stable with less than +1% growth over 2019. And the transfers that were actually completed increased by around +3% over 2019.

Other Popular Blog Posts

Discover more from Brander Group

Subscribe to get the latest posts sent to your email.

2024

2024