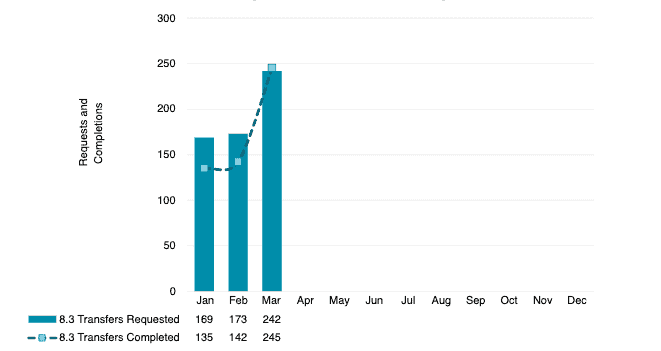

So far 2021 has started with a hockey stick demand curve for IPv4 addresses. If you look at the numbers, the ARIN pre-approval requests have increased 10% over the previous quarter, and a whopping +30% over Q1 of 2020. In fact, Q1 of 2021 has indicated the largest requests for ARIN pre-approval of all time with a 584 in total. This increase in demand seems to be linked to the continued number of users working from home in what seems to be this years theme once again.

What we also noticed last year was most suppliers moved their focus from re-addressing IPv4 subnets to COVID contingency plans. While some organizations have started to release IP’s again, we are still waiting for more put their inventory into the market. This is clearly indicated in the number of completions for Q1 of 2021, which is currently only 522. Do the market fell short by -10% filling organizations needs for IPv4.

We are currently in a unique situation that hasn’t been seen in the industry since its inception in 2015. There is very little supply and organizations are fighting for the chance to purchase whatever they can to support growth for the year. This is in turn has pushed the price curve significantly in favor of anyone who has available IPv4 address blocks.

As we continue to watch the IPv4 develop, we can only wonder how many more IPs are available to free up and can we keep up with the current rate of demand.

ARIN-IPv4-Transfers-Q1-2021

Other Popular Blog Posts

Discover more from Brander Group

Subscribe to get the latest posts sent to your email.

2024

2024