The Impact of Interest Rates Rising on IPv4 Pricing

In 2023, many people believed the IPv4 market had experienced a downward spiral that was most likely due to the fluctuations in demand and surplus of supply from the previous year.

To further explore this belief, let’s take a closer look at the events that helped shape the IPv4 market in 2023 and how those events affected demand, supply, and IPv4 pricing.

One of the biggest drivers of doubt in 2023 (across most markets) was the excessive increase in interest rates. This led to far fewer organizations borrowing capital, which likely contributed to unforeseen bankruptcies mergers, and acquisitions throughout the year. Moreover, the need for additional cash drove many organizations to flood the market with their IPv4 address space to help offset losses and to supplement the need to borrow money.

As a result of these circumstances, the IPv4 market reacted in a very interesting manner. More desirable and rare subnets such as /16s and larger maintained their prices at over $50 per IP depending on the overall lot size. However, the mid-market and smaller blocks composing of /17s down to /24s experienced a significant decrease of -20% to -40% in value.

This presented opportunities for certain organizations with seemingly unlimited budgets that were unphased by increased interest rates. For example, large cloud providers who were able to take advantage of the temporary pricing stability of /16s and larger, which typically increase yearly. At the same time, any other organization that had available funds were able to take advantage of the significant discounts for mid-sized and smaller IPv4 subnets that they would inevitably need over the next few years. Let’s analyze the numbers to determine what occurred.

IPv4 Demand & Price Variances 2019-2023 (Excluding /16’s+)

| Year | Avg. Demand | Demand Variance (Y/Y) | Avg. Price Per IP | Price Variance (Y/Y) |

| 2019 | 166 | 0% | $20 | 18% |

| 2020 | 167 | 0% | $24 | 20% |

| 2021 | 156 | -7% | $38 | 58% |

| 2022 | 134 | -17% | $48 | 26% |

| 2023 | 141 | 5% | $41 | -14% |

The 2023 IPv4 Market was Better than Expected

Contrary to what most people believed, the IPv4 market performed better in terms of transfer requests per month. Demand increased from an average of 134 requests in 2022 to an average of 141 requests in 2023, demonstrating a +5% delta. That trend showed a much better outlook compared to the transfer trends of the previous 2 years.

With that said, the average price fell from $48 to $41 per IP, indicating a -14% decrease in price. However, 2023’s average was still better than the average from 2021, potentially indicating an upcoming stable and healthy market.

ACAM and BEAD Likely to Spike Demand

As mentioned in our past blog posts, the U.S. Government already released $18 Billion in ACAM Funding and has begun to release an additional $42 Billion in BEAD Funding. The two initiatives are meant to accelerate the development of internet speeds and availability in rural communities across the United States as part of the Internet for All program. The funds are designated to purchase upstream internet connectivity, network gear, technical planning services, and IPv4 addresses. As we saw previously with RDOF initiative, this can quickly create a spike in demand for IPv4 addresses.

Using Data to Predict 2024 Prices

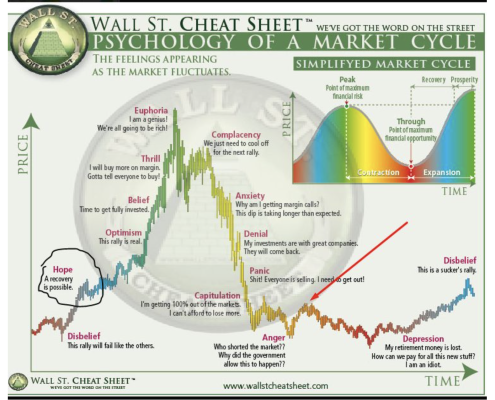

Historical data and proper analysis typically enable us to make more accurate predictions future events. Traditional market fundamentals and models, even more significantly in rare commodities, typically follow a certain pattern over a period of time:

- Sharp Increase

- Correction (Typically Choppy)

- Sharp Decrease

- Period of Stability

- Another Sharp Increase

Provided IPv4 industry follows traditional market fundamentals, there is a high likelihood that there will be a shortage of IPv4 addresses followed by a spike in IPv4 prices in the foreseeable future. Our team will closely monitor the market supply to prepare our clients for the inevitable price spikes to come in 2024.

Last year demonstrated that even when the odds are not favorable, with the right understanding of market fundamentals, one can still make out better with the proper information and guidance. We anticipate another strong year with positive news to share with the IPv4 and network community in 2024.

The Psychology of a Market Cycle

Brander Group’s Impact on the Global IPv4 Market

Brander Group has been established as the global market leader in the IPv4 market. Our research, customer support, proprietary systems, and large client base has established Brander Group as the most trustworthy source available in any market.

In 2023, our team successfully processed 505 IPv4 Transfers globally, which consisted of 4,126,176 total IP Addresses, with total sales revenue of $192 Million (USD).

Our total number of transfers increased by +8% over last year and contributed to around 30% of total IPv4 transfers market share on any given month globally. While seeing a slight decrease, our total number of IPs transferred, and total sales revenue beat the rest of the market by only decreasing around -15% over 2023.

IPv4 Market Recap for 2023 – IPv4 Transfer Requests in 2023

Other Popular Blog Posts

Discover more from Brander Group

Subscribe to get the latest posts sent to your email.