Posts

Inverse Correlation Between IPv4 Pricing and Demand

IPv4 Blog58 million IPs were transferred in 2025. This 28% year-over-year increase, paired with a 33% price decrease, highlights an inverse correlation between demand and pricing

IPv4 Demand Refuses to Fade: A Market That Keeps Booming

IPv4 BlogARIN IPv4 transfer requests totaled 150 in November 2025, signaling steady activity and buyer-friendly conditions in the IPv4 market

IPv4 Transfers Healthy in Anticipation of Broadband Builds

IPv4 BlogIn October, ARIN recorded 147 IP transfer requests, only modestly lower than September’s 153 and on par with this year’s monthly average of around 148 per month.

IPv4 Prices Stable as Hyperscalers Step Back

IPv4 BlogIPv4 market demand remains strong with 153 transfers in September, maintaining momentum as hyperscalers take a step Back

IPv4 Market Remains Stable & Prices Stay Competitive

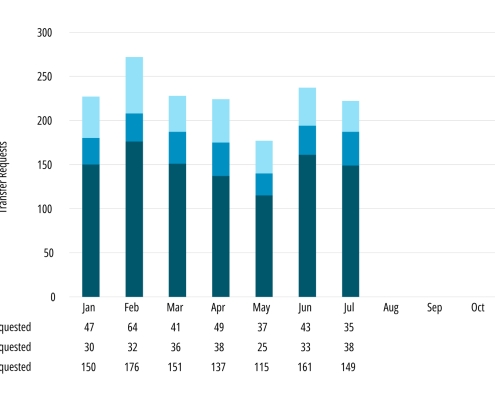

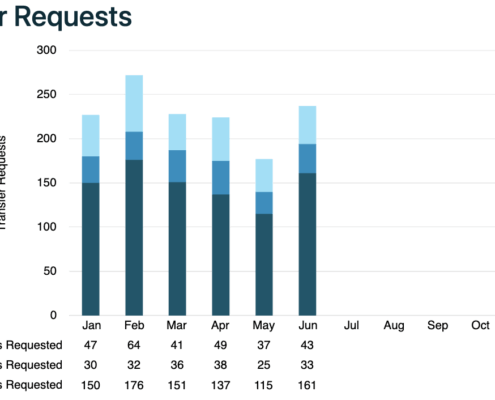

IPv4 BlogWith 143 Transfer requests in Augsut, the IPv4 market has shown resilience, adaptability, and strength despite the dip to 115 requests in May

IPv4 Demand Remains Resilient Despite One Down Month

IPv4 BlogARIN IPv4 transfer requests remain strong in 2025. Despite market dips and policy shifts, demand stays steady across buyers and sellers.

IPv4 Market Activity Rebounds Amid BEAD Program Delays

IPv4 BlogJune IPv4 transfers rebound; telecoms buy aggressively, while enterprises offload space amid BEAD delays and cloud migrations.

Surge in IPv4 Transfers Contrasts With Declining Demand

IPv4 BlogApril saw a dip to 137 requests, -10% below the year’s average, however, transfers surge. With 18M transfers, 2025 is on track for a 7-year high.

Resilient IPv4 Demand Amid Trumps $42 Billion BEAD Delays

IPv4 BlogAverage number of IPv4 transfer requests is 157 per month. An increase of +8% compared to 145 in 2024, +11% compared to 141 in 2023, and +17% compared to 134 in 2022.

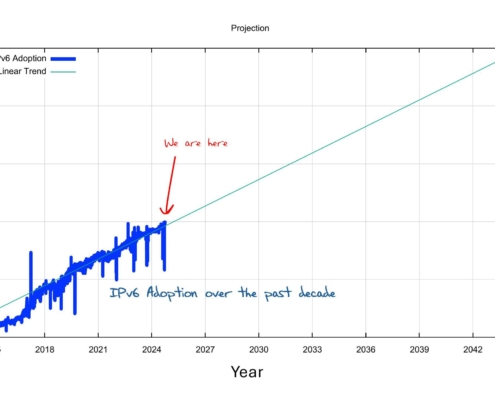

How Does NAT Affect the Transition to IPv6 Addressing?

IPv4 BlogSee how the widespread adoption of Network Address Translation has significantly prolonged the need to transition from IPv4 to IPv6.