Posts

Where is IPv4 Availability Heading as we Close Out 2024?

IPv4 BlogOn average, the 143 requests in 2024 surpass the average 137 between 2022 and 2023, showing signs of stability and possible growth

Recent -20% Dip in Demand Creates IPv4 Buying Opportunity

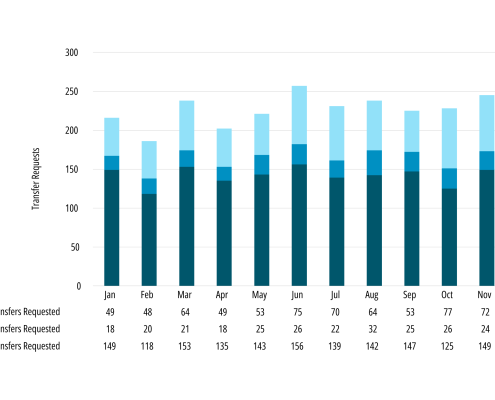

IPv4 BlogThere has been significant dip in IPv4 transfer requests. In June of 2024, request dropped -20% to 113 as compared to the month prior at 142. This yeas average has dropped to around 146 transfer requests per month, so June fell short around -22%.

Comparing Value of IPv4 & Bitcoin, the Rarest Asset Classes

IPv4 BlogSimilar to Bitcoin, IPv4 addresses continue to remain some of the rarest and most valuable asset classes in the world. However, unlike other physical resources that are considered “rare” such as gold & diamonds, these digital assets share a unique quality....

2024

2024IPv4 Addresses Validated as a Valuable Asset Class

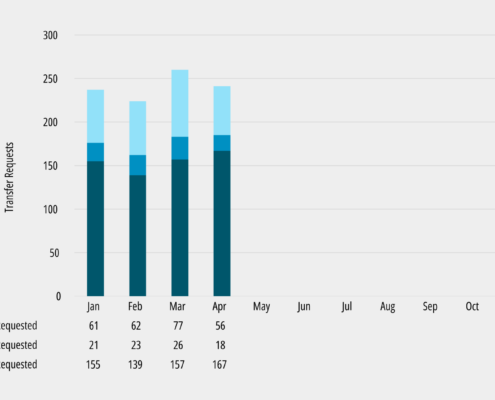

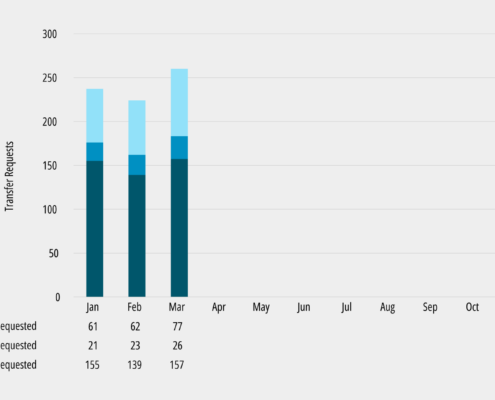

IPv4 BlogApril IPv4 transfer requests were 163, which is +7% higher than this year’s average of 150 requests per month. Better off, April is a +13% increase over the 141 averages in 2023 and a +18% increase over the 134 averages in 2022.

2024

2024Cogent Offers $206 Million in Secured Notes Backed by IPv4

IPv4 BlogCogent Communications (NASDAQ: CCOI), a leading global internet service provider, announced on April 25th 2024 a groundbreaking securitization offering. This move will see Cogent utilizing a significant portion of its IPv4 address space to issue up to $206,000,000 in securitized notes.

Is IPv4 Availability Becoming Scarce in 2024?

IPv4 BlogIn recent years, the IPv4 market has been on a relentless upward trajectory, defying expectations, and confounding skeptics. Despite occasional setbacks and bouts of volatility, the overall trend has been undeniably bullish. What is driving this sustained optimism, and what does it mean for the network infrastructure industry?

IPv4 Demand Stability Leading to Increased Activity

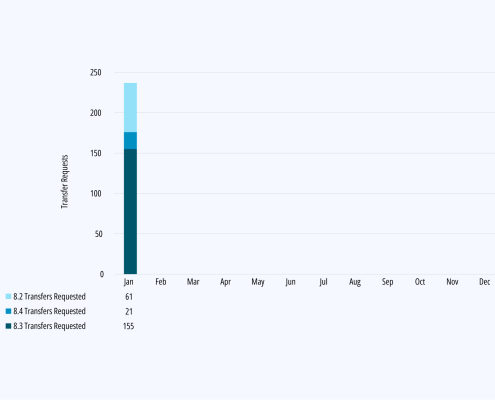

IPv4 BlogLike any healthy and predictable market cycle, IPv4 demand continues to remain steady. This consistency further promotes the notion of a stable market since there was no serious fluctuation in either direction.

2024

2024IPv4 Market Recap, Patterns & 2024 Price Predictions

IPv4 BlogUse data and market psychology to compare IPv4 prices from previous years and determine what IPv4 price might be in 2024

How Will Market Stability Affect IPv4 Prices in 2024

IPv4 BlogIn 2024, U.S. “Internet for All” initiatives – $18 billion E-ACAM program and $42 Billion BEAD program – indicate increased IPv4 demand.

Case Studies

Purchasing IPv4 Addreses

Buying IPv4Cable One partnered with Brander Group to procure 340,000 IPv4 addresses across multiple organizations since 2018.