Posts

Surge in IPv4 Transfers Contrasts With Declining Demand

IPv4 BlogApril saw a dip to 137 requests, -10% below the year’s average, however, transfers surge. With 18M transfers, 2025 is on track for a 7-year high.

Resilient IPv4 Demand Amid Trumps $42 Billion BEAD Delays

IPv4 BlogAverage number of IPv4 transfer requests is 157 per month. An increase of +8% compared to 145 in 2024, +11% compared to 141 in 2023, and +17% compared to 134 in 2022.

Cogent Raises $174M By Securitizing IPv4 Addresses

IPv4 BlogCogent’s $174 million IPv4 securitization signals a new approach to monetizing address space in the tech and telecom sectors

How Does NAT Affect the Transition to IPv6 Addressing?

IPv4 BlogSee how the widespread adoption of Network Address Translation has significantly prolonged the need to transition from IPv4 to IPv6.

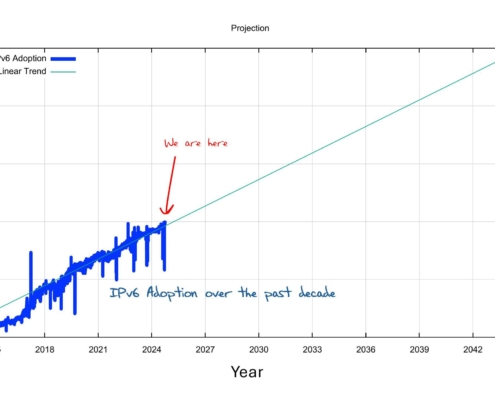

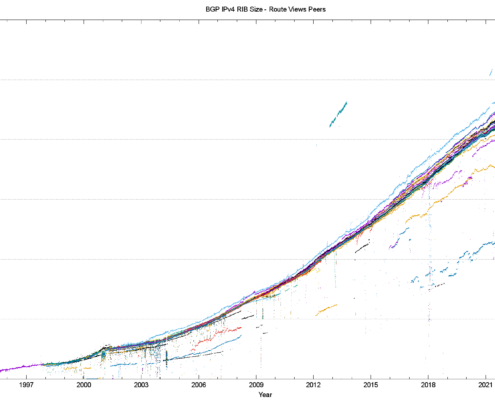

Analysis of IPv4 vs IPv6 in BGP Routing Tables

BEAD NewsThe blog post provides an analysis of the Border Gateway Protocol (BGP) routing tables' growth and dynamics for both IPv4 and IPv6 during 2024.

IPv4 Market is Thriving: A Surge in Transfers

IPv4 BlogIn February 2025, IPv4 transfers jumped to 176, up from 150 in January. This represents a +17.3% month-over-month increase

February Showing Strong IPv4 Demand Driven by BEAD

IPv4 BlogJanuary 2025 started strong with 150 IPv4 transfer requests. This is an increase of +4% compared to 2024, +6% compared to 2023 and +12% over 2022. Looks like a positive trend over the last three years since we saw the market dip to the bottom.

2025 IPv4 Outlook: Preparing For the Next Market Cycle

IPv4 BlogExplore the dynamics of the IPv4 market in 2024 as compared to previous years. Determine the IPv4 prices in 2025 and stay ahead of the rest with a competitive edge

China Ramps Up IPv6 Adoption Amid Slowing Growth

IPv4 BlogChallenges and measures introduced by Beijing, in the progress of IPv6 adoption in China and the efforts being made to maintain momentum

How Fluctuating Demand Might Affect IPv4 Prices

IPv4 BlogOctober had the highest number of transfer requests of the year at 172. As compared to the consistent average of 143 transfer requests per month in 2024, October experienced a significant increase of +20%.