As the economy continues to adapt and recover from COVID, the IPv4 transfer market continues to show signs to growth. Companies on in the market to sell IP addresses and those who need to purchase IPv4 are showing signs of growth and activity.

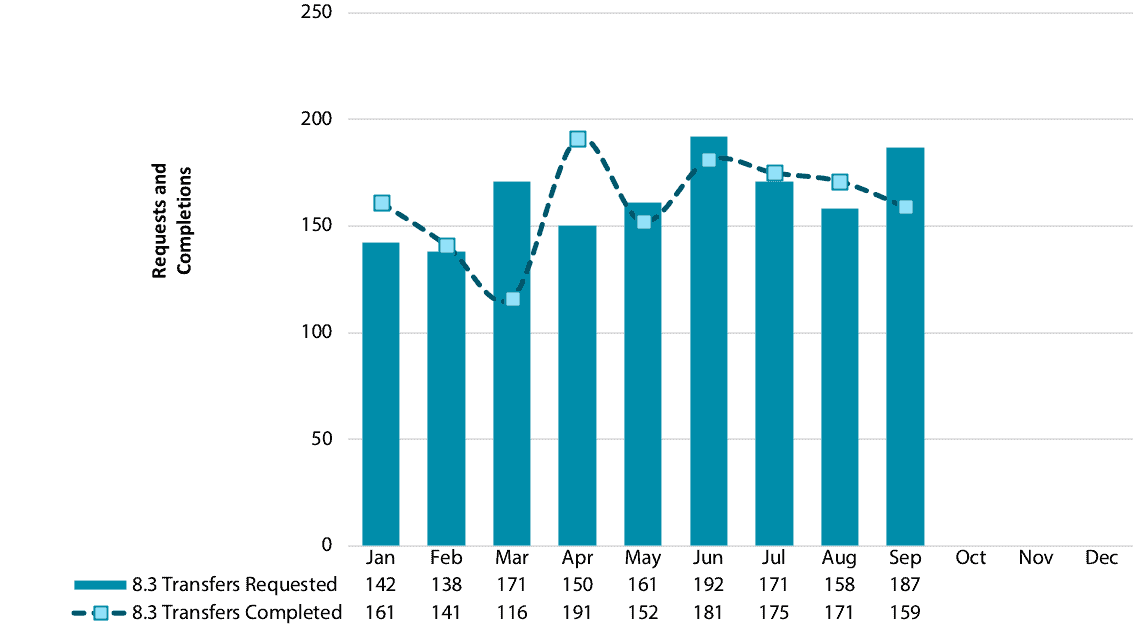

As of Q3 of 2020, the IP address market is starting to look much more positive than it did 2019. If you dive into the numbers of requests in ARIN, you will see a +3% increase over Q2 and a +14% increase over Q1. If you compare Q3 of 2020 to Q3 of 2019, we also see a +5% increase. Any way you look at it, there is an upward trend in the demand for IP addresses leading into Q4, which usually has a lot of transfer activity.

Overall completions are at 98%. Which shows that there has been enough inventory to cover the demand. However, we have noticed that while there is enough for small block transfer, larger subnets have been difficult to find. As the market continues to unfold and demand continues to increase, IPs will become more difficult to find.

Q4 tends to have the biggest spikes in demand, and the least amount of available inventory. Anyone who will have a need for IPs in the first quarter of 2021 should try to get them now, before prices spike and there are waitlists…

Other Popular Blog Posts

Discover more from Brander Group

Subscribe to get the latest posts sent to your email.