Posts

The United States Federal Government’s IPv6 Mandate

IPv4 BlogThe U.S. Federal Government's mandate to adopt IPv6 by fiscal year ending 2025. Recent developments and projections for the OMB IPv6 mandate.

2024

2024IPv4 Addresses Validated as a Valuable Asset Class

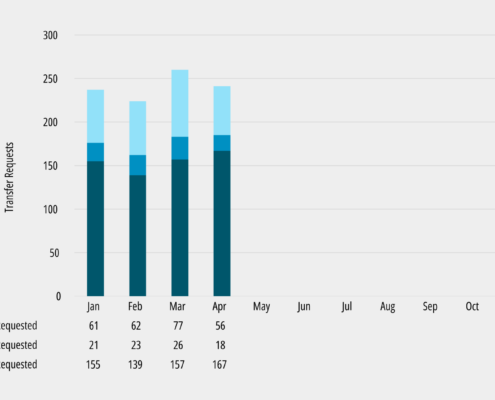

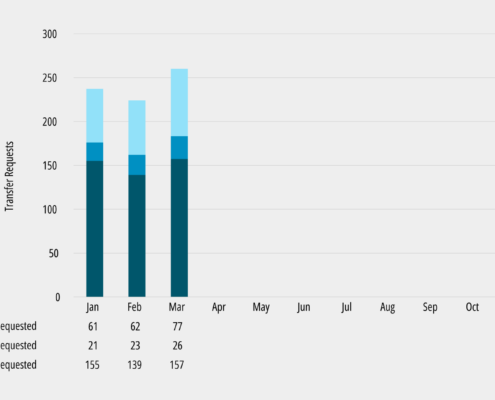

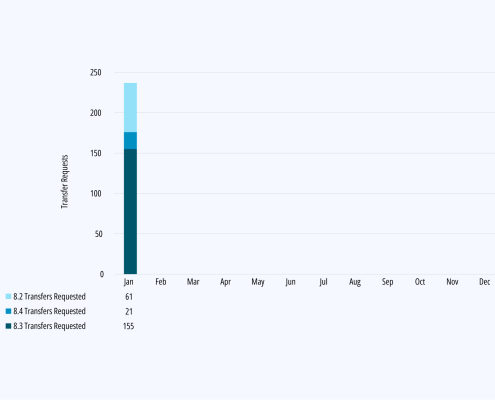

IPv4 BlogApril IPv4 transfer requests were 163, which is +7% higher than this year’s average of 150 requests per month. Better off, April is a +13% increase over the 141 averages in 2023 and a +18% increase over the 134 averages in 2022.

2024

2024Cogent Offers $206 Million in Secured Notes Backed by IPv4

IPv4 BlogCogent Communications (NASDAQ: CCOI), a leading global internet service provider, announced on April 25th 2024 a groundbreaking securitization offering. This move will see Cogent utilizing a significant portion of its IPv4 address space to issue up to $206,000,000 in securitized notes.

Is IPv4 Availability Becoming Scarce in 2024?

IPv4 BlogIn recent years, the IPv4 market has been on a relentless upward trajectory, defying expectations, and confounding skeptics. Despite occasional setbacks and bouts of volatility, the overall trend has been undeniably bullish. What is driving this sustained optimism, and what does it mean for the network infrastructure industry?

IPv4 Demand Stability Leading to Increased Activity

IPv4 BlogLike any healthy and predictable market cycle, IPv4 demand continues to remain steady. This consistency further promotes the notion of a stable market since there was no serious fluctuation in either direction.

How Will Market Stability Affect IPv4 Prices in 2024

IPv4 BlogIn 2024, U.S. “Internet for All” initiatives – $18 billion E-ACAM program and $42 Billion BEAD program – indicate increased IPv4 demand.

IPv4 Transfer Requests Outpace Previous Year – November

IPv4 BlogAfter fluctuations, the IPv4 Market has exhibited price and demand stability since January 2023, increasing confidence for a strong 2024. The number of IPv4 Transfer Requests has also increased year-to-date, promoting informed market decision-making.

Signs of a Stable & Healthy IPv4 Market – October 2023

IPv4 BlogA healthy market, whether it's a financial market, real estate market, or any other type of market, is characterized by certain signs and conditions that indicate stability, efficiency, and fairness. The IPv4 market began in response to the exhaustion of a rare technology and a surge in client demand in 2015.

IPv4 Transfer Market Stability – August 2023

IPv4 BlogEven in uncertain times, the IPv4 address market continues on a steady path of recovery. After approximately 18 months of demand decreasing and significant price drops, there is now a glimmer of hope on the horizon. Perhaps, sentiment regarding inflation and heightened interest rates are affecting the market as we near the new year; with anticipation of positive news and more stability.

$42 Billion Broadband Equity Access & Deployment Program

IPv4 BlogIn a world where connectivity is no longer a luxury but a necessity, the digital divide remains a stark reality for many communities. The emergence of the Broadband Equity Access and Deployment (BEAD) program, a groundbreaking initiative with a budget of $42.45 Billion, promises to reshape the landscape of internet accessibility, economic empowerment, and educational advancement for underserved areas across the nation.