Posts

Brander Group Completes $87 Million IPv4 Sale

Company NewsSeptember 2022 - Brander Group Inc recently sold approximately 1.7 million IP addresses for over $87 million. T2022 revenue exceeds $200 million.

IPv4 Price Stabilization & Comparison – June 2022

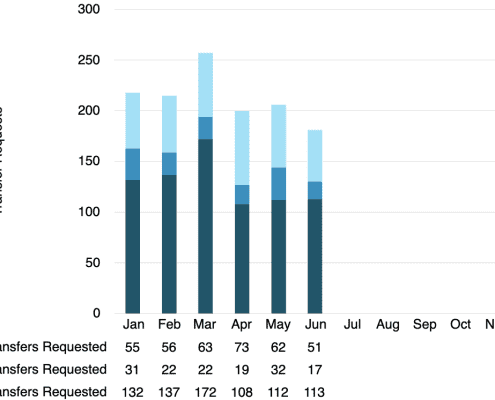

IPv4 BlogAs of June 2022, the IPv4 market seems to have created a new IPv4 demand baseline. With only 113 IPv4 transfer requests last month, we have a 3-month average of 111 transfer requests. While this is a steady stream of demand, the rest of the picture paints an interesting story for the end of the year.

Recessions Impact on IPv4 Sales – May 2022

IPv4 BlogThe general consensus amongst many stock market analysts indicate that our economy might be headed into a recession. As seen in past instances, the IPv4 transfer market tends to follow the the global stock market. With the stock market continuing to decline, so do the number of IPv4 transfer requests, which is a strong indicator of the current global IPv4 demand.

Significant IPv4 Demand Volatility in April 2022

IPv4 BlogApril 2022 transfer requests decreased to only 108, demonstrating another massive decrease of -37% as compared to March. When looking at the average of 137 transfer requests in 2022, the decrease is still very significant at -21%. Interestingly enough, the April & Mays average transfer requests are still 140 per month, which does align with what we have found to be the “new IPv4 norm” over the last 11 months.

ARIN IPv4 Transfer Volatility October 2021

IPv4 BlogWhile we have had a strong run and increase in IPv4 demand over the previous 3-4 months, October seemed to have slowed down a bit. The total number of IPv4 transfer requests in ARIN dropped to 143, which is down -16% from 171 requests in September and -12% from the 163 average requests over the course of 2021.

ARIN IPv4 Transfers Increase September 2021

IPv4 BlogSeptember IPv4 market trends have been very positive compared to what we saw as the average of the previous 3 months. Signs of life from IPv4 buyers are visible based on the increase of IPv4 transfers requested again from 167 in August to 171 in September.

Case Studies

Consolidate & Sell IPv4

Selling IPv4Mitel worked with Brander Group to readdress, consolidate, and monetize surplus unused IPv4 addresses, after mergers and acquisitions.

Sell Surplus IP Addresses

Selling IPv4How Rehmann Technology Solutions worked with Brander Group to consolidate, readdress, and sell its holdings of IPv4 addresses.

2024

2024Migrate & Monetize IPv4

Selling IPv4Maritz worked with Brander Group to consolidate a large amount of IPv4 addresses, and capture substantial revenue from surplus IP assets.

2024

2024Readdressing & IPv4 Sale

Selling IPv4Brander Group worked with Abilene Christian University on the readdressing and sale of IPv4 addresses, and to monetize unused IP addresses.