Posts

Mature and Stable IPv4 Market in 2024

IPv4 BlogAs 2024 draws to a close, the IPv4 market is finishing the year on a strong note. Demand for IPv4 addresses has remained robust, underscoring the continued importance of this finite resource in a growing digital economy. Compared to the volatile market trends seen in the past two years, 2024 has proven to be a year of stability and sustained growth.

How Fluctuating Demand Might Affect IPv4 Prices

IPv4 BlogOctober had the highest number of transfer requests of the year at 172. As compared to the consistent average of 143 transfer requests per month in 2024, October experienced a significant increase of +20%.

Exclusive Insights: 10 Years of IPv4 Address Transfer Statistics

IPv4 BlogWe analysed 10 years of IPv4 transfer data, compared 16s and larger to /24 through /17 subnets, and use trends to predict how initiatives like BEAD funding will influence supply and prices in 2025

Shifting Landscape of the IPv4 Transfer Market

IPv4 BlogThe IPv4 market has bounced back to 142 transfer requests in August 2024, which is right in line with this year’s average of 143 per month. Last month’s demand indicated an increase of +12% over July and a whopping +25% over June. With even better news, the 143 average is still up +5% over the average of 2022 and 2023.

Comparing Value of IPv4 & Bitcoin, the Rarest Asset Classes

IPv4 BlogSimilar to Bitcoin, IPv4 addresses continue to remain some of the rarest and most valuable asset classes in the world. However, unlike other physical resources that are considered “rare” such as gold & diamonds, these digital assets share a unique quality....

2024

2024IPv4 Addresses Validated as a Valuable Asset Class

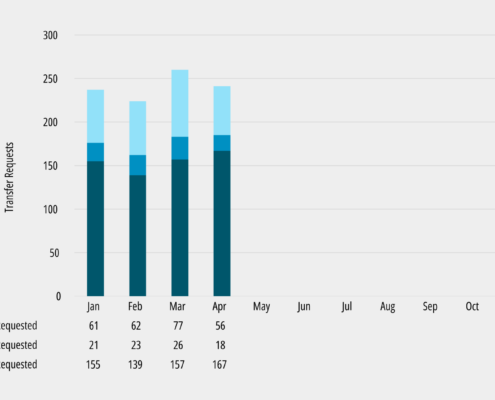

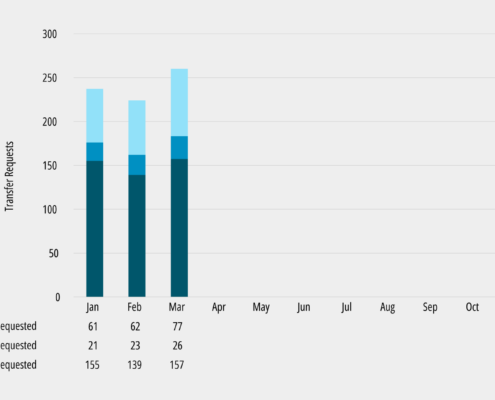

IPv4 BlogApril IPv4 transfer requests were 163, which is +7% higher than this year’s average of 150 requests per month. Better off, April is a +13% increase over the 141 averages in 2023 and a +18% increase over the 134 averages in 2022.

2024

2024Cogent Offers $206 Million in Secured Notes Backed by IPv4

IPv4 BlogCogent Communications (NASDAQ: CCOI), a leading global internet service provider, announced on April 25th 2024 a groundbreaking securitization offering. This move will see Cogent utilizing a significant portion of its IPv4 address space to issue up to $206,000,000 in securitized notes.

Is IPv4 Availability Becoming Scarce in 2024?

IPv4 BlogIn recent years, the IPv4 market has been on a relentless upward trajectory, defying expectations, and confounding skeptics. Despite occasional setbacks and bouts of volatility, the overall trend has been undeniably bullish. What is driving this sustained optimism, and what does it mean for the network infrastructure industry?

Brander Group Exclusive Partnership with HESS

Company NewsAugust 1, 2023 - Brander Group has extended its exclusive partnership with the Higher Education Systems & Services Consortium (HESS Consortium)

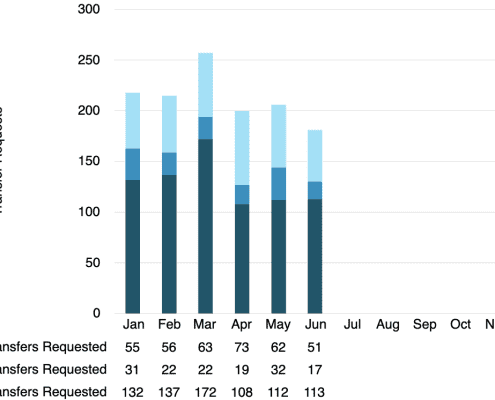

IPv4 Price Stabilization & Comparison – June 2022

IPv4 BlogAs of June 2022, the IPv4 market seems to have created a new IPv4 demand baseline. With only 113 IPv4 transfer requests last month, we have a 3-month average of 111 transfer requests. While this is a steady stream of demand, the rest of the picture paints an interesting story for the end of the year.